All Categories

Featured

Table of Contents

You can include these to a supply profile to obtain some direct exposure to realty without the initiative of situated or vesting deals. Historically returns have been excellent with REITs yet there is no pledge or assurance and they will certainly fluctuate in worth swiftly. Below are some advantages and disadvantages of REITs: REITs are highly fluid financial investments due to the fact that they are traded on supply exchanges, allowing capitalists to buy or market shares at any kind of time they want.

REITs are subject to comprehensive governing oversight, including reporting demands and conformity with particular revenue circulation guidelines. This degree of guideline offers openness and financier protection, making it a fairly safe alternative to avoid fraud or untrustworthy drivers. Historically, REITs have provided affordable returns, frequently equivalent to or perhaps going beyond those of stocks and bonds.

Real Estate Investment Networks For Accredited Investors

REITs are structured to be tax-efficient (Accredited Investor Real Estate Platforms). As an entity, they are excluded from federal income tax obligations as long as they distribute a minimum of 90% of their taxed revenue to shareholders. This can cause potentially higher returns and favorable tax treatment for capitalists. While REITs can offer diversification, several spend in industrial buildings, which can be prone to economic downturns and market variations.

Workplace and multifamily REITs could be encountering significant turbulence in the coming year with elevated interest prices and reduced need for the property. I have claimed many times the following chance is most likely commercial real estate due to the fact that those are the assets that have the most room to drop.

Why are Real Estate For Accredited Investors opportunities important?

You will certainly never read about these unless you know a person that knows a person who is included. Comparable to a REIT, these are swimming pools of cash made use of to acquire real estate. Right here are some advantages and downsides of a personal property fund: Personal property funds can possibly deliver higher returns contrasted to openly traded REITs, and other options, because they have the versatility to invest straight in residential or commercial properties with the goal of optimizing earnings.

Spending in an exclusive fund gives you access to a diversified portfolio of property properties. This diversity can assist spread danger across various building kinds and geographic areas. There are several real estate funds that either focus on domestic property or have property property as component of the overall profile.

Fund managers are commonly experts in the genuine estate industry. They make notified financial investment decisions, conduct due diligence, and actively manage the properties within the fund to enhance returns. Because they do this complete time, they have the ability to locate far better deals than a lot of part-time energetic investors - Accredited Investor Property Portfolios. Usually, the manager of the fund will take a charge for their effort, yet they also contract out the administration at the asset level developing further splitting up between you and the underlying residential properties.

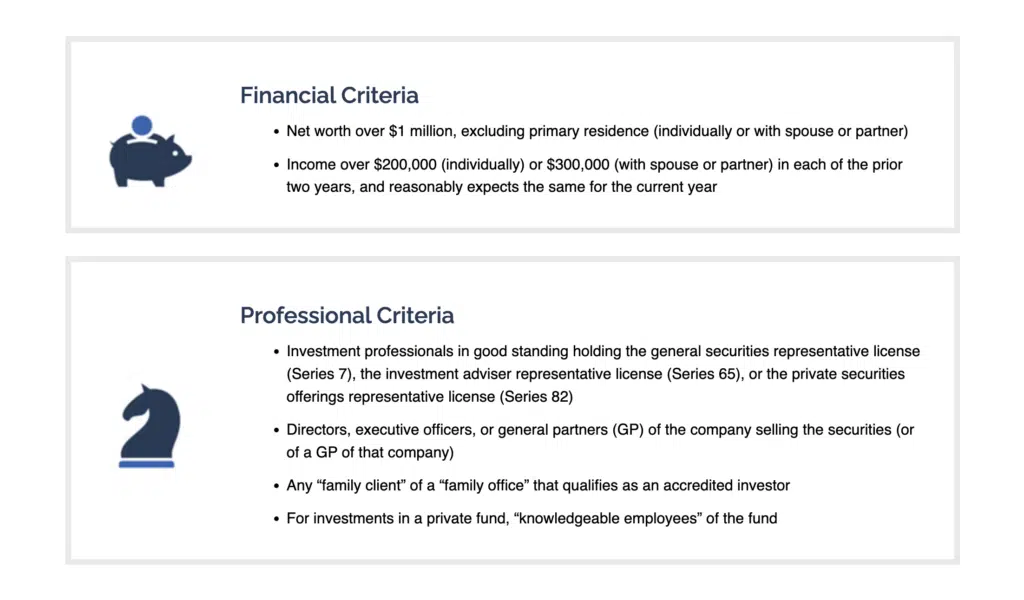

These financial investments are limited to accredited investors just. The interpretation of a recognized capitalist is a little bit wider than this but as a whole to be certified you require to have a $1 million total assets, unique of your main home, or make $200,000 as a solitary tax payer or $300,000 with a spouse or partner for the previous 2 years.

The difference is a fund is commonly bought several projects while submission is typically limited to one. House submissions have been incredibly preferred in current years. Below are some advantages and negative aspects of a submission: Among the main advantages of several realty submissions is that financiers may have a say in the residential property's management and decision-making.

What are the benefits of Real Estate Crowdfunding For Accredited Investors for accredited investors?

Effective submissions can generate considerable revenues, particularly when the property values in value or creates constant rental income. Capitalists can gain from the residential or commercial property's financial efficiency. I have actually made returns of over 100% in some submissions I purchased. Syndications can be highly conscious adjustments in rate of interest. When rates of interest climb, it can boost the expense of financing for the property, possibly affecting returns and the overall feasibility of the investment.

The success of a submission greatly depends upon the proficiency and honesty of the driver or sponsor. Recent cases of scams in the submission space have actually elevated problems about the integrity of some operators. There are a handful of significant examples but none smaller sized than the recent Give Cardon accusations.

Exiting a syndication can be challenging if it is even feasible. If it is permitted, it usually calls for finding another capitalist to acquire your stake or else you might be required to wait up until the residential or commercial property is offered or refinanced. With extremely rare exceptions, these investments are reserved for certified capitalists only.

This is purchasing a pool of cash that is made use of to make finances versus property (Accredited Investor Commercial Real Estate Deals). As opposed to having the physical property and going through that possible disadvantage, a home loan fund only purchases the paper and makes use of the realty to protect the investment in a worst-case circumstance

They create income via passion payments on mortgages, offering a predictable cash money flow to capitalists. Repayments come in regardless of a lessee being in place or rental performance. The property does not shed worth if realty worths go down, thinking there is no default, since the possession is a note with a guarantee of repayment.

This enables for constant monthly repayments to the capitalists. Unlike exclusive funds and syndications, mortgage funds often use liquidity options.

Real Estate Syndication For Accredited Investors

It is not as fluid as a REIT but you can obtain your investment back if needed. Maybe the most significant benefit to a home loan fund is that it plays a critical duty in enhancing neighborhood communities. Home loan funds do this by offering loans to investor for residential or commercial property rehab and development.

The one prospective downside is that you may be providing up on potential returns by buying a secure asset. If you are alright taking losses and intend to gamble for the higher return, among the other fund options might be a better fit. If you are seeking some secure diversification a mortgage fund might be a great enhancement to your portfolio.

Why are Accredited Investor Real Estate Syndication opportunities important?

The Stocks and Exchange Commission (SEC) has certain policies that financiers require to fulfill, and typically non certified capitalists do not fulfill these. For those that do, there is a chance to invest in startups. Crowdfunding platforms now supply non accredited investors the possibility to purchase equity of startups conveniently, by bypassing the SEC guidelines and being able to invest with a reduced upfront funding quantity.

Table of Contents

Latest Posts

Who Pays Property Taxes On Foreclosed Homes

Back Taxes Auction

Surplus Payments

More

Latest Posts

Who Pays Property Taxes On Foreclosed Homes

Back Taxes Auction

Surplus Payments